- Credit Suisse’s two price targets for AT&T (one conditional on the merger) are both over 10% the current price.

- The merger between AT&T and Directv will likely go through.

- AT&T can - but needn’t - compromise with Netflix, the merger’s opposition.

Credit Suisse (CS) is well known even to investors and traders not interested in this particular stock. The reason is CS’s influence on the market: when it announces a target price for a particular stock, the market moves. For many of us traders, CS’s target prices aren’t words to live by but simply slight gusts of wind that push us to make an investment decision we have been contemplating. For me, recently, it was CS’s price target of 105 on Procter & Gamble (PG) that influenced me to buy the stock while it was trading below 82.

But sometimes CS’s price targets are conditional, as in the case of AT&T (T). CS has set a 38 dollar price target on T should T’s merger with DIRECTV (DTV) go through. That equates to a 10% jump in the stock price, much of which would likely come after the merger has been officially announced. And therein lies the question: Will the merger go through?

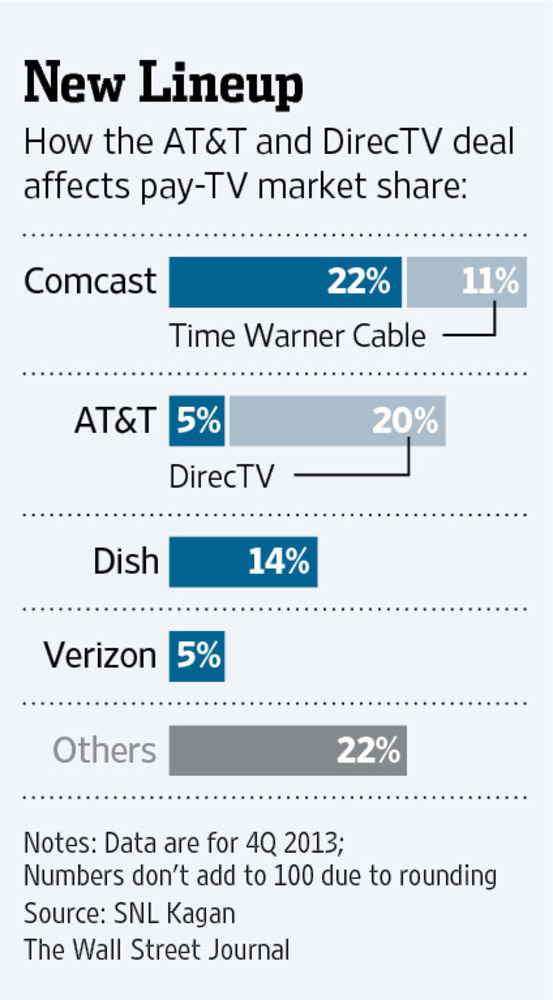

Analysts have been seeking the answer for months. Most are optimistic. Telecommunications and law professor Rob Frieden predicts a 75% probability of a successful merger. CS gives the merger a 70% probability of succeeding. But these estimations were before Netflix (NFLX) opened its mouth, pressing regulators to halt the merger. The merger would make AT&T the largest of all the pay-per-view providers, a fact that obviously isn’t good for NFLX, especially in light of the already increasing competition in the streaming market. But does NFLX have any real influence? And do its oppositions have any real backing?

Browsing the news would have you believing that NFLX is outright opposed to the merger. However, that is not their official stance. A closer look reveals that NFLX isn’t opposed to the merger but the implications the merger has for competition in the streaming market – and in this sense of the word “competition,” NFLX is referring to itself. In essence, NFLX’s appeal to the FCC is that the merger would limit consumer choices (e.g., the ability to choose NFLX over T and DTV’s services). NFLX contends that after the merger, T and DTV will strengthen their hold on consumers by limiting choices and innovation for online video. Thus, to metaphorically shred NFLX’s petition, T and DTV only need (1) present their merger in a light that promotes competition and innovation or (2) alter the merger to compromise with NFLX.

The first option would be easy enough, as NFLX’s filing with the FCC is not a formal petition to deny the merger. T and DTV would only need point out that the merger would lead to a company with only 25% of the market share in pay-TV. Consumers will still have plenty of choices after the merger.

Source: The Wall Street Journal

The second option would be to add restrictions to the merger, restrictions that do not unfairly limit competition. One of NFLX’s main concerns here is that T and DTV could monopolize the pay-TV market by forming the biggest ISP in the nation, which raises issues of net neutrality. Furthermore, after expanding their reach through expanding broadband to 15 million new homes (mostly in rural areas), T and DTV could raise prices unabashedly, which obviously would not be good for consumers. So here, the question becomes, “What restrictions could T and DTV possibly add to the merger that would address NFLX’s concerns?” Not many obviously solutions are readily available, besides promising to adhere to strict net-neutrality laws or sacrificing some revenue plans that NFLX sees as unfair – such as charging for inter-network connections and direct connections.

In either case, the merger seems likely to go through. Some investors have had a bearish outlook on T due to its recent business innovations. With T’s buying up of some of Mexico’s biggest wireless carriers, the costly acquisition of AWS-3 spectrum licenses, and its push to merge with DTV, T has been denounced by certain analysts as having become reckless with its pocketbook. But remember that T has deep, deep pockets (much deeper than NFLX, at 300 billion in assets compared to NFLX’s 9 billion) and can fight battles on many fronts.

Overall, for mega-cap stocks like T, having good financials is often the key to growth. Good fundamentals attract investor support, a stark contrast to the micro-cap world where investor support attracts investor support. Taking risks while maintaining a strong balance sheet will only help T. Should this merger go through, expect a price spike. But even if the merger does not go through, CS’s price target for a merger-less T remains high at 36, implying that T is undervalued even without the merger. The merger is unlikely to fail, but even if it does, T will not fail. And investors buying into T now are likely getting a considerable discount on a company with strong growth potential and dividends to boot.

No Comment