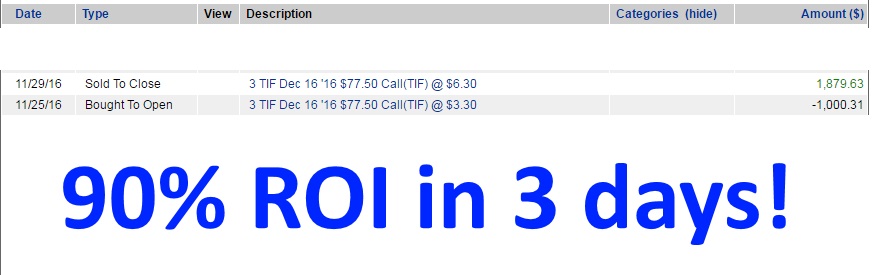

TIF (full example from Copy My Trades)

SIG, another jewelry company recently reported a beat, suggesting a bullishness in this sector. TIF is a rarity in the jewelry market in that it is the only well-known US brand. The advantage of it being a US company that primarily makes its profit in the US is not having to deal with Forex issues; a strong dollar does not hurt TIF so much.

Fundamentally, we should not predict any surprises in margins or growth. EPS growth has been negative for the past six quarters. That might change this quarter, and if it does, it will be taken as a sign of growth turnaround. We are not banking on that, but it’s a good catalyst.

TIF is going to be presenting forward guidance on its FQ4 during this quarter’s earnings. FQ4 is TIF’s best quarter and the main profit-driver of the company. Guidance should be strong.

Why?

For one, retail sales and spending are picking back up in the US, specifically in the luxury market. But of more interest to TIF investors recently is its flagship store, which brings in 30% of TIF’s sales and 10% of its profits. This store is located right next to the Trump Tower and has been the focus of concerned, nervous TIF investors.

Are the nearby protests reducing sales?

Is the red tape preventing customers from entering the store?

If you search the news quickly, the answers seem to be “yes.” But how much of that news is real and how much of it is part of a lingering “blame Trump” mentality in the liberal media? Others have reported unobstructed entrances to the store and strong foot traffic.

This is the typical overreaction you get when an easily understood news item can be interpreted by investors. Overall, if you limit the supply of a luxury item or raise the barriers to obtaining it, you make it more enticing, fueling demand. It’s an abstract concept, certainly moreso than:

“Trump president; neighboring doors hard to open; Trump bad; Chinese tourist scared, no buy jewelry; TIF stock down; my aunt said Apple computers are easy to use so we should buy Apple stock…”

…low-level thinking for low-level traders and investors. Ignore the news, at least on the surface, please.

This is TIF’s strong season. And it covers earnings. The probability that TIF rises on a beat is nearly 100%; the probability that TIF rises on a miss is nearly 50%.

The statistics are on our side regardless of last quarter, which I believe will be good anyhow. The focus is guidance. Management will likely point to everything I just pointed to above: strengthening sales, a possible turnaround in EPS on the way, and a positive spin on the Trump presidency/neighborhood.

If TIF is treated as a luxury stock, it is fairly valued. If it is treated as a retail stock it is undervalued. Either way, this does not put the risk profile against us; rather, it works in our favor, especially with options.

Today will be our last day to open this trade, and as evidenced by Wedneday, many are already buying last-minute. We will too. Here is our play:

Buy TIF Dec16 $75 call

This is an at-the-money call that maximizes our gamma – i.e., we gain the best nonlinear risk/reward profile possible with a long call at this strike. Because TIF is a “reverter” after earnings, it dips a bit after a rally and rises a bit after a fall. We can regain ground if we are wrong, but we should sell immediately if we are right.

Why a pure long call? Simply because options are fairly valued on TIF right now. No need to overcomplicate things, especially seeing as I get follow-up emails every time I send out a complex options strategy; we only have a few hours to open this trade, so we shouldn’t be racking our brains with the reasoning for the strategy.