SINA: News Analysis vs. Technical Analysis

Contents

SINA doesn’t play shoots and ladders; she only plays shoots:

The Technical Analysis for SINA

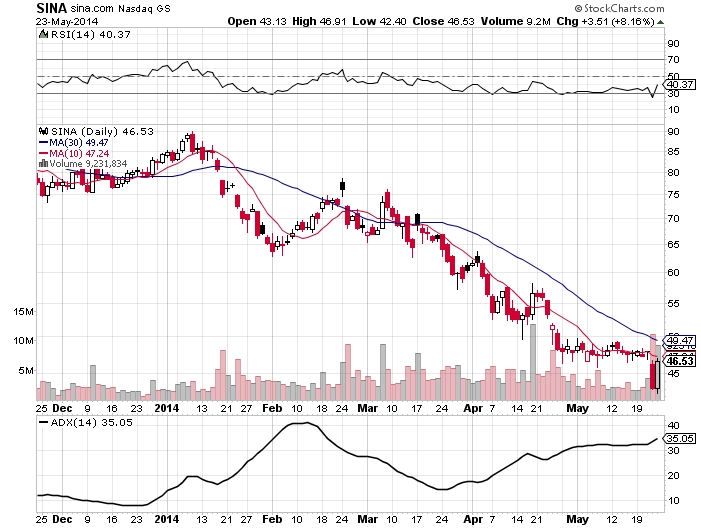

SINA has a strong downward trend in the long-term, mid-term and short-term, assuming your definition of short term is not limited to one or two days. No interesting candlesticks or gaps would imply the reversal of this downward trend. And the typical indicators, such as the moving averages and the average directional index imply that this bearish trend is likely to continue. Then what do we make of this:

As you can see, on May 22, SINA took a sharp drop downward. Then, on the next day, it immediately shot up, retracing its initial loss. Does this imply a new trend? How do we explain this?

If you read the news for your stock picks – and you shouldn’t – you’d find a negative piece of news related to SINA. A typical stock analyst would explain that the drop in the stock price was the reaction to the news and that the following rise in the stock price was a retrace of an overreaction.

Sina Corp is a pretty active stock in terms of news reports. If a single news report can have such an impact on SINA, then we should consider it volatile. Every week, something comes out discussing Sina Corp and its related companies. Thus, making a move such as a naked call or put would seem rather stupid.

Luckily, we don’t read the news (or at least we don’t factor it into our decision-making).

Thus, my explanation would be this: SINA’s relative strength index (RSI) has been quite low since the end of April. While it has been hovering at a little above 30, only last week did it dip below 30, implying that the stock was likely oversold. Naturally, an oversold stock will hop upward momentarily, explaining SINA’s quick rise. But the overall bearish trend will not be affected by oversold stock regaining its volume equilibrium. Thus, SINA should continue downward despite its current one-day bullish trend.

My Prediction for SINA

Based on technical analysis alone, SINA should continue downward. Of course, another possible prediction is that the sudden $5 increase we saw yesterday in the strike price trend is a new, fast bullish trend. I’m going to make a move that will help me profit off the downward trend while protecting myself from the possibility of a new bullish trend.

My Move | SINA Bear Call Spread

I believe SINA is at its relative highpoint. But I also believe that the downward trend still holds. I intend to capitalize on SINA’s temporary high price by selling call options at $47.5. But should SINA continue its upward trend, I will have protection: I will also be buying call options at $49.5. Thus, if what happened yesterday repeats itself, I will only suffer a limited loss. I will buy this call option early rather than watching the stock so that I can get a better price for it should I need to buy it. It’s a form of insurance and is what defines the bear call spread. I will be buying 2-day options because I don’t trust SINA to continually stay below $47.5 for a series of weeks.

Cost of buying 5 May30 calls at 49.5: ($170)

Profit from selling 5 May30 calls at 47.5: $400

Net profit from the Bear Call Spread: $230

No Comment