When new investors first begin to understand dividends, they come up with a brilliant idea: “What if I buy a stock just before the ex-dividend date and sell it right after the dividend payout? Could I essentially collect the dividend without having to hold the stock?”

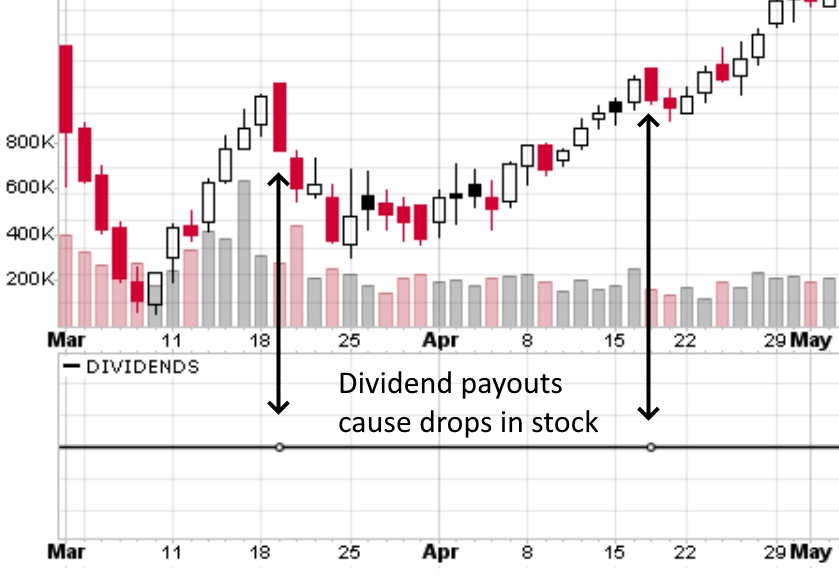

The market contains free few lunches – or arbitrage situations – and this is no exception. Buying a stock before the ex-dividend date but after the dividend declaration means you are paying the “cum-dividend” price, which accounts for the dividend payout. To sell the stock after the dividend payout, you are selling at the “ex-dividend” price, which does not include the dividend. You would generally experience no profit from this strategy because you would be buying at a high, selling at a low (the stock price drops by the dividend amount on the dividend payout date), and collecting a dividend to make up for the difference. Thus, you would not find an arbitrage opportunity in this strategy.

However, with options strategies, you can find arbitrage opportunities on dividend stocks. I will present two of them. One is little-known, and the other is almost completely unknown.

Strategy 1: Buying in-the-money (ITM) Puts

In this strategy, we copy the “wrong” strategy that is mentioned above, but with an added trick. In short, we buy the stock before the ex-dividend date, while simultaneously buying an ITM put option on the stock. When the dividend is paid, in addition to collecting the dividend, we sell the stock and sell the put (or just exercise the put).

This strategy works because the put option will gain value equivalent to the loss in the stock. This means we lose nothing when the stock drops due to the dividend payout. Yet – we still collect the dividend!

Running this strategy gives positive profit with zero-to-little risk. Whether the risk is zero or “little” depends on the put option you buy. Hence the only snag in this strategy is that we must find an ITM put option that will work with this strategy.

How do we find an ITM put that works? We need to perform a quick calculation. First, look at the price of the stock – we will call this P. Then, choose your ITM put option’s strike price – we will call this S. After that, note the dividend payout – we will call this D. Finally, note the cost of the option (the price you pay for the option) – we will call this C.

We must check that the following is true before we can ensure that this strategy is an arbitrage play:

D > C - (S - P)

That is, if the dividend payout is more than the cost of the option minus the extrinsic value of the option (the strike price minus the stock price), we have a zero-risk dividend arbitrage strategy opportunity.

For example, consider a stock that pays a $1.3 dividend. Let’s say we find a put option that costs $1.80. It is ITM, with the strike being $1 higher than the stock price. Here,

1.3 > 1.8 – 1

Thus, we can buy the stock (100 shares) and buy the put option for this play, knowing that we have zero risk.

The only trouble with this strategy is finding the right put option, as many do not fulfill the above inequality. Happy hunting.

Strategy 2: Selling ITM Calls

This strategy works on a similar timeline as the above strategy but uses ITM call options instead of put options. However, the fundamentals upon which this strategy works are completely different. Instead of searching for put options that are mispriced, we are relying on probabilities.

Just as the price of ITM put options go up when the dividend is paid, ITM call options drop in price after the ex-dividend date. Holders of ITM call options on stocks with dividends are entitled to the dividend payment if they exercise the call options. Thus, past the ex-dividend date, ITM call options that have not been exercised lose the dividend value.

It seems obvious that anyone holding an ITM call option on a dividend stock will exercise the ITM call option before the ex-dividend date. Yet the statistics show that roughly half of all ITM call options on dividend stocks go un-exercised. The reasons for this vary, but the fact remains: Buyers of ITM call options before the ex-dividend date tend to lose money, while the writers gain, on average.

A strategy that works on the law of large numbers is to buy the stock while selling an ITM call. Here, we have a 50% chance of the call not being exercised. This produces two possibilities.

The first is that the call is not exercised. We then can buy back the call at a price lower than that at which we bought it. This is where our profit comes from. While we also collect the dividend on the stock, the stock falls in value, creating no losses or gains on that side of things.

It is arbitrage because it is no risk for the other 50% of the time. If we hold the stock and the ITM call we sold is exercised, we must pay the dividend to the person who exercised the call. However, because we are holding the stock, we also collect the dividend. Thus, we suffer no loss here. But, we still profited from the credit we received when selling the call option. Both situations pay off.

Strategy C: Combining the Two

Finally, if you want to make things more complex, you can run both strategies on the same stock. In other words, buy the stock (two lots, or 200 shares), buy an ITM put, and sell an ITM call.

Here, you have a 50% chance of the call not being exercised, and gaining profit from the fall in its value; buy it back. In the other situation, you keep the credit from the short call but must pay the dividend, which is covered 2x by the dividends you have collected. Then, on the dividend payout, the put gains in value equal to the loss of one of your lots of stock, while the other falls to the same degree of the “extra” dividend collected.

Essentially, you are just running both dividend arbitrage strategies simultaneously. Try it out.

Happy trading!

No Comment