AMSWA: Showing a Rare Evening Doji Star

Contents

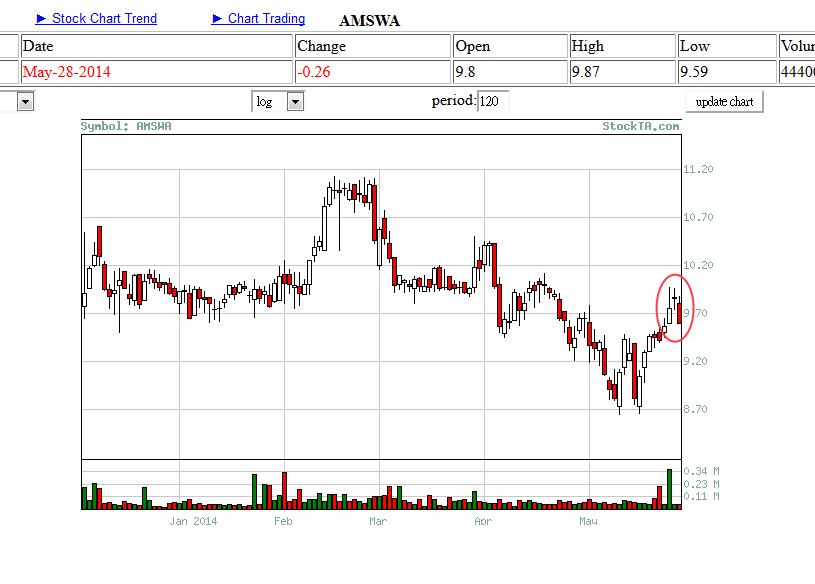

I previously bought two puts on AMSWA at the strike price of $10. While the stock immediately dropped after I bought the puts, it again rose. However, as I was watching AMSWA, I noticed something rare: an evening doji star:

The Technical Analysis for AMSWA

If you look at the circled area above, you’ll see the evening doji star. This pattern consists of a white candlestick following by a high doji star, which itself is followed by a lower red candle stick. If the body of the doji star gaps above its surrounding candlesticks, it becomes a evening doji star, one of the rarer candlestick patterns.

But despite its rarity, the evening doji star has statistically predictability. With statistical significance, the trend following an evening doji star is bearish. This is especially true for evening doji stars that contain tall candlesticks. The candlesticks for AMSWA are of moderately large size, making this evening doji star more indicative of a following bearish trend.

My Prediction for AMSWA

Because my original prediction was that AMSWA would fall, I already have two put options from May. Though my original prediction proved to be true only in the short term, I am getting prepared to sell them due the appearance of the evening doji star. My prediction is the same as last time’s but for a different reason. This is a candlestick pattern prediction: AMSWA will fall.

My Move | AMSWA In-the-Money Put

Because of the rarity of this candlestick pattern, I have decided to buy more puts. These puts will cost me less than the previous puts I’ve bought due to the expiration date being closer to today. Thus, I am buying 4 more:

Cost to buy 4 June 21 puts at $10: ($160)

Net cost of put strategy: ($160)

No Comment