4 Areas for Improvement - Silk Invest

Contents

The following is a comprehensive audit for Silk Invest.

(If you want an audit for your own hedge fund, contact Damon here.)

Who Is Silk Invest?

Based in London, Silk Invest runs the Silk African Lions Fund, a hedge fund focusing on growth on the African continent.

Founded in 2009, it has produced a total return of 50.84% and broke the $50M AUM point in 2012.

Why Audit Silk Invest?

Despite their profitability and breaking the $50M AUM point, which many hedge funds get stuck under, growth in AUM has been slow. Considering the financial growth of Africa and the Middle East, and, as they Silk Invest states themselves, the fact that the markets they focus on will house half the world by 2030, a hedge fund with such a focusing should be growing more quickly than $5M per year (or about 6% per year). As a hedge fund cannot increase its AUM without more investors, I believe Silk Invest’s weak point is how it presents itself to investors, particularly through its website.

My goal in this article is not to insult Silk Invest, but to help them and other hedge funds who feel stuck in the same area. I believe Silk Invest in on the right road and only needs a little bit of wheel-greasing to go faster.

Disclaimer

I am not affiliated with Silk Invest, nor am I an investor in their Silk African Lions Fund. I was not commissioned to write this audit and do not have any access to internal data. All the data on Silk Investments in this fund came from publicly available sources.

I am writing this audit primarily to help hedge funds understand how to better market their own funds.

If you have any questions regarding this disclaimer, please contact me.

Usability Issues

At a lack of a better place to start, I’ll relay my experience, which should more-or-less mimic that of an investor who might be interested in investing in Silk Invest’s fund.

I originally saw the Silk African Lions Fund a month back or so when searching for African investment funds. I recently decided to look it up on my phone while eating Dim Sum the other day. That’s when I met with the main problems an investor is likely to meet: Silk Invest’s website usability issues.

Silk Invest’s mobile website is crisp and beautiful. But I saw no link to their African Lions Fund on their website, even under the “products” section. I used the search function, but the website failed to display anything – perhaps it was a problem with my phone, I thought. So I decided to look it up again when I got home later that evening.

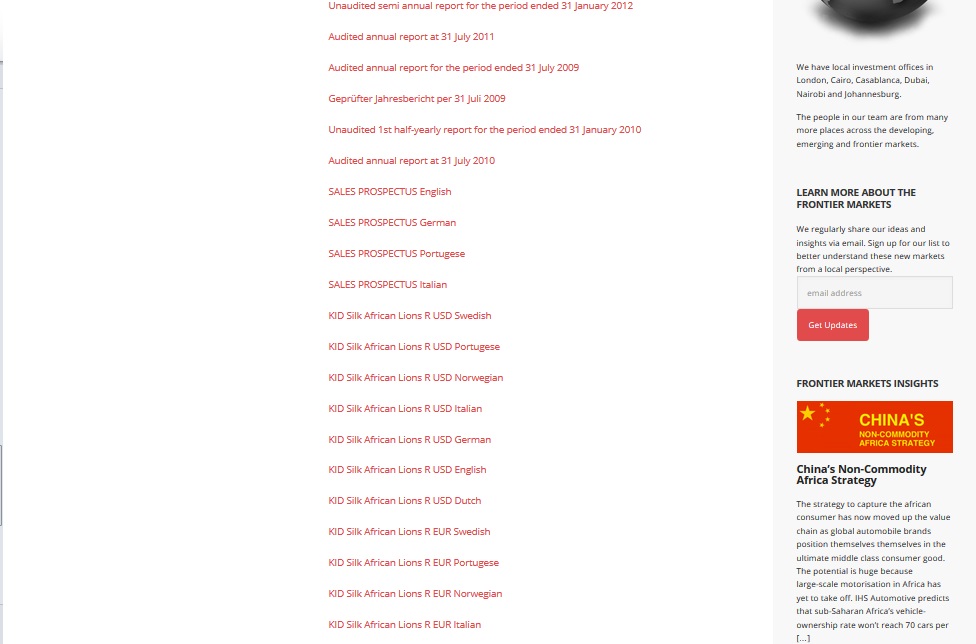

I returned to Silk Invest’s website, typed “African Lions” into the search box and got this mess:

And that’s only half of the results. I wasn’t sure what to click, so I just chose the “KID Silk African Lions R USD English” link and got a PDF download.

A PDF? Why? Perhaps Silk Invest has its reasons, and I don’t know what percentage of their traffic is coming from mobile devices, but no one is going to read a PDF on a smart phone. Already, they are making the investment process more troublesome than it need be.

Tip: Investors have lots of options and very little time, so the easier you can make the experience for them, the better.

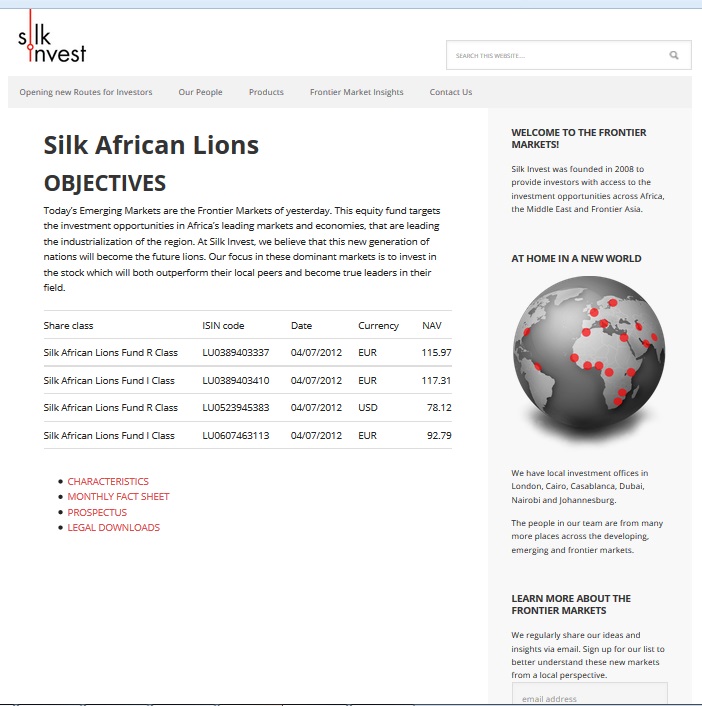

I wanted to see a webpage on the Silk Invest site on the African Lions Fund, not a PDF document. So I returned to Google (not good for Silk Invest!), typed in “African Lions Fund” and finally got to the right page, seen here:

A one-paragraph website with links to – you guessed it – PDFs!

PDFs are great for printing out to show investors in person, but they will kill your ability to convert on the web, for a variety of reasons.

Tip: Always convert PDFs to HTML for web use.

Tip: NEVER make a user return to Google to find something on your site.

Visibility

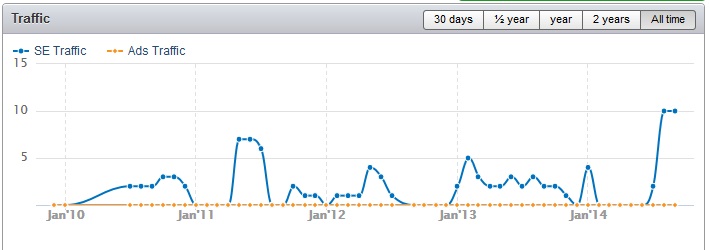

After I looked into the data describing Silk Invest’s online presence, I realized why they hadn’t made any changes that would inevitably follow readers’ complaints about everything being a PDF document: Silk Invest’s website barely has any readers. Their website, good-looking as it may be, only gets around 5 readers per day, which is a pity:

Perhaps Silk Invest simply doesn’t care about online marketing and is using a website as more of a business card, telling prospects face-to-face, “Check us out on the web.” Unfortunately, for a fund heavily involved in areas that could benefit the most from online marketing (i.e., if you live abroad and want US investors, the best ways are to either move to the US or find them online), it has completely ignored online marketing strategies.

If I were the manager of Silk Invest’s marketing, I would do two things to immediately get large amount of traffic.

First, I would start running PPC ads. At present, Silk Invest is not running a single PPC ad. Yes, PPC ads can be expensive, but I’ve found several search terms they could target for much cheaper than the rest of the hedge fund industry. And paying out a few bucks for a lead that will end up putting $100,000 in your fund is nothing.

Tip: When launching a new website for your fund, run a short-term PPC ad campaign to get immediate traffic and a footprint in Google.

Second, after looking at the traffic Silk Invest’s website is getting, I’ve noticed some interesting search terms that they could easily obtain the top position in Google for. This would give them an influx of free traffic from prospects who are exactly interested in what Silk Invest is offering. Thus, I would run an SEO campaign – mainly via content marketing, as I believe a hedge fund should start out with education before pitching.

Tip: Find low-competition keywords that match your fund; these keywords will be easy to rank for in Google, quickly getting your name to the top.

These two steps would turn Silk Invest’s website from a placeholder to a prospect-generation tool.

Relationship-Building

I worked hard to find information on Silk Invest’s African Lions Fund. How hard is Silk Invest working to get information on me?

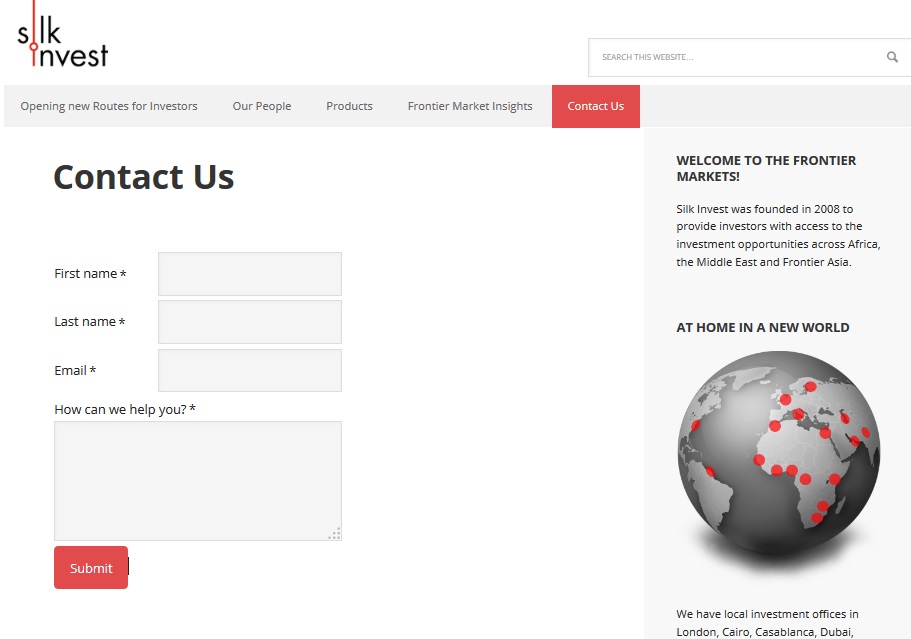

At present, Silk Invest isn’t attempting to convert any of its traffic to prospects. Either they don’t have a marketing plan to this extent or they are hoping that the prospects will do all the work in contacting them – they do have a “contact us” page, after all:

Tip: Never leave your contact page blank, without text or reasons to fill out the contact form. A blank contact us page is meaningless.

Something cheap and easy Silk Invest could set up on their website is an opt-in email list. On average, email marketing produces a 4,300% ROI, according to the Direct Marketing Association. This ROI was calculated mostly based on B2C businesses, which sell inexpensive products. Imagine how much ROI a hedge fund can get from a proper email marketing setup.

Silk Invest can set up an email marketing list that broadcasts to its subscribers important information on their industry, the African and Middle East markets, and important information about the fund itself. By letting subscribers in on information that’s not available (or easy to find) on the website, Silk Invest will be creating value for the subscriber, thus building a relationship that could turn into an investment.

I know some hedge funds are averse to email “marketing” (it doesn’t have to appear like marketing), but the statistics tell a different story. According to Merkle, nearly 3 out of every 4 investors prefer to receive contact through email. In addition, a hedge fund can easily track email and pivot its strategy to increase the open rate of emails and responses to emails (e.g., signing up for a meeting with the fund).

With the low cost involved in email marketing, a hedge fund really has no excuse not to be using it. That goes for Silk Invest as well.

Update: I wrote the above before realizing that Silk Invest does have an email list. However, it’s not at all easy to find or opt-in to. Not only is the email list opt-in below the fold (meaning you’ll have to scroll down to find it), but it’s also gray, blending in with the background. This is the first time I’ve met with a camouflaged email list:

Now, while I’d like to take back what I said and praise Silk Invest on a job well-done with email marketing, I just can’t. There are two main problems:

First, the email list isn’t easy to opt-in to. It looks easy, asking only for an email address. But after you enter your email address, it takes you to a new registration form that requires you to enter many more details, including your company’s name and country.

Tip: Make email list opt-ins as easy as possible. The more information you ask for, the fewer subscribers you’ll get.

Second, I didn’t get any follow-up email from the fund. To me, this means the fund doesn’t have any email automation. They might have someone manually responding to emails, but I certainly didn’t get a response. A good email marketing campaign has automated parts, including the welcome letter and a follow-up series educating the subscriber on:

- What to do next.

- How to use the list.

- What to expect in the future.

Silk Invest should reconsider the reason they put that email opt-in on their website in the first place.

Blog

Silk Invest has done many things right with its blog. It has long, informative, in-depth posts on the market (not the fund). These posts are likely to grab the attention of a reader, while simultaneously convincing the reader that Silk Invest is an expert on the African markets. This is where Silk Invest has done a good job and is likely the reason for their (albeit small) income of traffic from search engines.

Every one of their blog posts has a video embedded, which is great. They also have text in the blog post so it’s not just video, an essential tactic in getting your blog post found by search engines. One possible mistake they make though is that all of their videos are in-site videos instead of YouTube videos. I say this is a possible mistake because using your own video service is not a bad thing but it lacks the social media power and traffic you get from using YouTube. If I were running Silk Invest’s marketing campaign, I would also link to a YouTube version of the video (though not embed it) so as to possibly get some YouTube subscribers.

Another excellent thing Silk Invest is doing with its blog is adding calls to action at the bottom of each blog post. Once you’ve watched their video and read their post, you’re met with a link or a download and prompted to “learn more.” This is a great strategy that helps hedge funds transition from educating to marketing.

In fact, I don’t have many negative critiques for this blog. But judging from the traffic brought into the site, something must not be working. It’s obvious to me that “something” is frequency. On average Silk Invest posts one new blog post a month – not good for traffic or for gaining reader loyalty.

At the very least, they should be publishing once per week. I understand that they might have it in their plan to include a video in every blog post. I understand videos take a while to produce. But in the meantime, they could be creating some video-less blog posts to help them attract traffic to the site. Even if they don’t have anyone to write a regular blog, outsourcing the blog to an expert on the African markets shouldn’t cost more than a few hundred bucks (4 blog posts per month at ~$100 a post).

Conclusion

I hope that this audit has helped some hedge funds (and Silk Invest!) see what areas are important to improve upon. Silk Invest has a good-looking site and a high quality blog – literally, two investments. Yet they aren’t leveraging these two investments to their potential, as they are missing the essential aspects of usability, visibility, and relationship-building. In the future, I would like to see Silk Invest’s website improve in these three areas.

No Comment