The following is a comprehensive audit for Man Group.

(If you want an audit for your own hedge fund, contact Damon here.)

Who Is Man Group?

Contents

Man Group is an investment management group run out of London. They run the GLG Balanced Managed Retail hedge fund, which targets “average” investors as opposed to high-income individuals and institutions. This fund is primarily based on investing in the biggest of UK companies, which can prove problematic for their marketing.

Yet started in 2000, Man Group’s hedge fund has done rather well. They are currently managing over $600 M AUM. Startups take note: this is with a minimum investment of one thousand pounds.

Some aspects of Man Group’s hedge fund allows it to market itself. For instance, investors need not pay an incentive fee, and the management fee is only 1.5%, as opposed to the standard 2%. In addition, there is no lockup.

However, other aspects, such as the poor annual returns and its incredibly high correlation with the FTSE 100 require Man Group to market the fund in creative ways. At this point, they are likely relying on their size and history in the industry to convince investors to put money in the hedge fund instead of an ETF. With hundreds of new startups pouring into the hedge fund industry, Man Group cannot simply rely on its reputation if it is to continue growing its investor base.

Why Audit Man?

Man Group’s poor performance relative to the S&P 500 and its high correlation to the FTSE make it a logically poor choice for the average investor - investing in an index fund would bring in more money. In addition, as an older company, it is less flexible than a hedge fund startup. This audit is both to make Man Group aware of its marketing defects and to show startup hedge funds a case study.

Disclaimer

I am not affiliated with nor a client of Man Group. I was not commissioned to write this audit. All the data in this article regarding Man Group was obtained from publicly available sources – I was not supplied with any internal data from Man Group Investments itself.

I am writing for both Man Group and other hedge funds who wish to find better ways to market their products.

If you have any questions regarding this disclaimer, please contact me.

Okay…

So there’s lots to talk about here, but let’s start with the most obvious marketing tool of Man Group: its website, man.com (no, it’s not a gay porn site).

Mistake #1: Mobile Site Problems

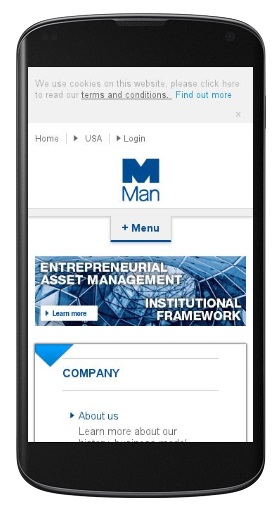

Over 60% of investors browse investment opportunities from mobile devices. This being the case, every hedge fund must have a mobile site. Luckily, Man Group does:

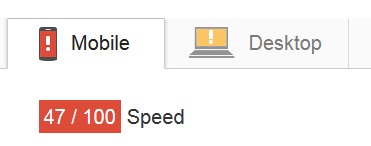

However the design of this site has problems. First of all, it was abnormally slow on my phone. I ran it through Google’s site speed test to ensure it wasn’t just my phone:

What follows are fixes that Man Group could easily implement for increased website speed:

- Fix all the landing page redirects. A landing page redirect is when you type in a URL, such as “man.com” and the website sends you somewhere else, such as “man.com/2/us”. Right now, you have 7 landing page redirects, listed below:

- http://man.com/

- http://www.man.com/

- https://www.man.com/

- https://www.man.com/GB

- http://www.man.com/GB/

- https://www.man.com/GB/

- https://www.man.com/GB/home

- https://www.man.com/US/home

All you have to do to fix this problem is copy the page that you want the user to see onto the original page. That is, instead of redirecting me from man.com to man.com/2/us, simply copy the content on man.com/2/us to man.com.

If you’re worried about different countries seeing irrelevant content, simply make the main page, man.com, a directory giving users choices of what country’s page they want to visit. Let the homepage be a map, in other words. This will drastically improve the speed of the site overall, mobile and desktop.

- Remove the fancy “above-the-fold” content. Above the fold content is the content users first see on their mobile phone, without having to scroll down. At the moment, it is graphically heavy, with a banner and several images. When you place this type of content via CSS and Javascript on your mobile site, it slows down the loading speed considerably. Rethink what you want users to first see and balance it with site speed.

- “Actually” put the important content on the page. What I mean by “actually” is that much of the content on the homepage is not encoded into the homepage’s HTML but is “called up” from other areas on the site and server. Try to keep all relevant content on the page instead of linking to other pages and images.

- Compress your images. At the moment, the images are too large. Remember that mobile phones are often browsing from slower-than-home, slower-than-office 3G connections or WiFi in Starbucks. You have many ways to compress your images so that they work great for both mobile and desktop sites. Try them out.

- Allow caching. When moving around the site, the website requires the phone to reload much repeat content. Caching allows the user’s mobile phone browser to store common images in the browser, which drastically increases site speed. For me, this is even more important, because my mobile Internet charges me by how much I download. If I find a site is forcing me to continually redownload content, I’ll generally find another source of information.

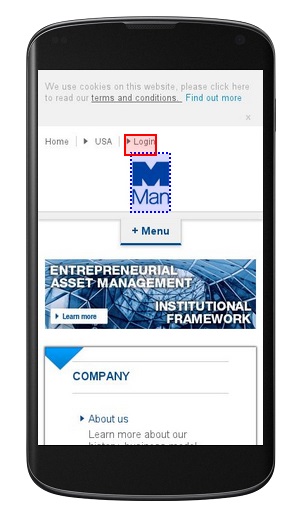

- Fix tap target sizes. Check out the image below. Imagining I’m an investor, I want to tap the tiny “login” item. However, my big, stupid finger seems to always hit the big M of the Man logo, bringing me back to the homepage. Switching to my pinky doesn’t help. The reason is that the tap area of the big “M” and the tiny “login” actually overlap, causing usability issues. Consider a redesign.

Tip: Always pretend you’re an investor and test your mobile site after launching it!

- Convert PDF information to a mobile-friendly format. How often do you download PDF files to your phone? I, for one, never download PDFs on my phone. It is utterly beyond me why so many hedge funds think PDF is the ideal source of information packaging for mobile sites.

Tip: Mobile sites and PDF files Don’t Mix!

Mistake #2: No Social Media Presence

For a big company, the avoidance of social media is inexcusable. Social media is no longer just for kids; investors are using it for research. Many companies still stick their heads in the sand with excuses such as “investors aren’t on Facebook and Twitter” when such a statement simply isn’t true.

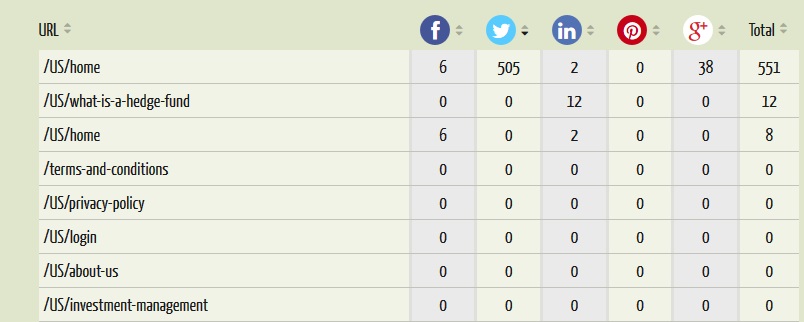

Yet Man Group knows to some extent that social media is important. From my analysis, it appears they believe social media will help their SEO efforts (it will, but not in the way they’re employing it now). If you look at the image below, you’ll see that all of their social media shares are links to the home page, which implies that this is part of an SEO campaign meant to “trick” Google into ranking them higher.

Only the LinkedIn shares seem to be real, as they are liking to actual content (“What Is a Hedge Fund?”). Over 500 Tweets about the homepage but not a single Tweet about site content? Google will notice such an inconsistency, which in turn will hurt Man Group’s SEO rankings.

In short, Man Group is using social media incorrectly. What follows are my tips for Man Group to more effectively use its client base in social media efforts:

- Get investors to talk about your fund via social media. While you can’t directly ask for and post testimonials in this industry, you can ask your clients to “mention” you, leaving it up to them what that means. You’ll likely have a few people talking about your great customer service, solid investment strategies, and so on via Twitter, G+ and Facebook.

- Send out important info about your fund via social media. Instead of packing up info in inconvenient PDF files, post it in a LinkedIn blog or group. Put your basic info on Facebook.

- Search out comments about your hedge fund and company. Respond to those commenters via social media. Not only will you show that your company has a face and cares about (both negative and positive) comments about your company, but you can also lead people into a conversation about your hedge fund and investment strategy.

- Use social media for proper SEO efforts. Social media works in improving your search rankings, but only if you do it the right way. For example, adding Google authorship to your site and linking it to Google+ profiles can help bring up your search rankings. Natural Google +1s often have the largest effect on your search rankings.

- Leverage your current clients for referrals. Ask them to share information and pages of your website to their friends and colleagues. You can often pull in at least one referral from every 3 clients, in my experience. That’s free money (no advertising required)! But most companies don’t even try.

Tip: Social media is free, easy to manage, and brings benefits to nearly every aspect of your business.

Mistake #3: Copy Too Short

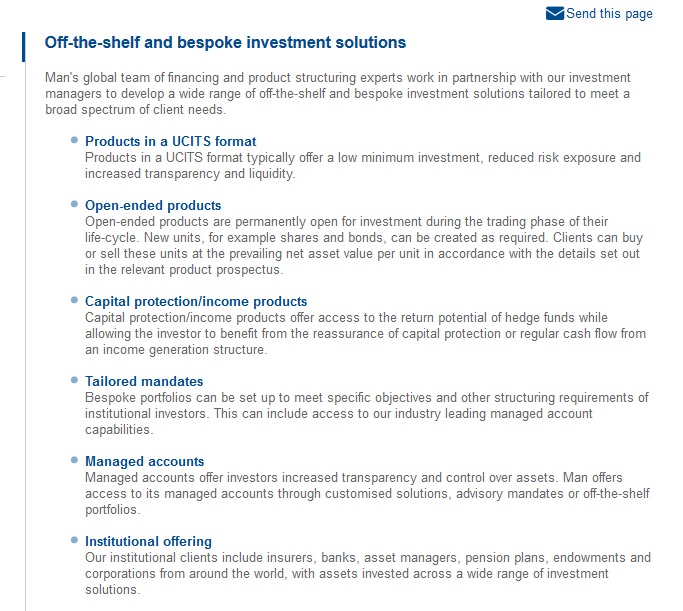

As a profession copywriter for five years, I’ve witnessed the change in web copy conventions. Some of these conventions are based on facts (e.g., shorter paragraphs convert better), but these facts don’t apply to every business. One such convention is the recent popularity of short copy followed by benefits in the form of bullet-points:

Tip: Effective copywriting strategies vary from one industry to another; the hedge fund industry is special in this regard.

Man Group is clearly following the convention here, which is good because it means they are up-to-date. However, for financial products, the convention produces lower conversions (e.g., less phone calls, less emails, etc.) than does long-form copy. The reason can be summed up by two facts:

- Individuals buying products requiring large investments need more information before they are willing to purchase.

- Financial products are a highly logical, non-spontaneous category of product and therefore require logical explanations to differentiate them from competitors – this requires longer copy.

In short (no pun intended), Man Group needs to lengthen its copy so as to explain each aspect of investing with them. In addition, they should do more to differentiate their hedge funds from those of their competitors.

And one more thing: the GLG Balanced Managed Retail hedge fund has a 92% correlation with the FTSE 100. A 92% correlation is almost unheard of in statistics and, here, essentially means that investing in a FTSE 100 index fund will bring me almost exactly the same returns as investing in the GLG Balanced Managed Retail hedge fund (which costs me management fees and has a minimum investment). So why would I want to invest with GLG? This is a point Man Group should address in its copy.

Tip: Long copy with evidence, statistics, and facts works very well in the financial industry whereas it tends to produce poor performances in other industries.

Mistake #4: Company-Centric Copy

David Ogilvy said that if you cannot think like an investor, you shouldn’t be marketing to investors at all. I agree and would urge Man Group to invest in a professional copywriter for their web copy and the copy in their PDF files.

At present, their style of writing is company-centric. Most of their informative content is about how great Man Group is, how long they’ve been in business, and other experience-related facts that you would expect on a resume.

Tip: Prospective investors aren’t interviewing you (yet); they are looking for solutions to their financial troubles.

Here are two super-effective tactics Man Group can use to make their copy more investor-centric:

- Avoid assuming that investors care about your company. Switch out the use of words such as “Man Group” and “we,” using words such as “you” and “our clients” instead. Make the copy about your investors. Only write about Man Group when you’re saying something useful to the investor, such as what you specialize in or why you’re different from the other hedge fund managers.

- Use a conversational tone. I know you guys are British, but I seriously doubt that you use words like “whilst” when talking to your mates at the pub. Take a casual tone with your web copy. Professionalism isn’t about word use; it’s about where you put your focus. For you website, the focus should be on making prospects easily understand who you are and what you’re offering.

Tip: Professionalism is about proper focus.

Conclusion

I hope the above four tips can help Man Group – an already successful investment firm – become more effective at attracting new investors. If you feel this audit was useful, please let me know by contacting me here.

No Comment