Have you ever heard that most hedge funds underperform a portfolio of randomly chosen stocks? It’s true! But that doesn’t mean all hedge funds are run by chimpanzees randomly hitting their keyboards with stock-trading software open.

The World's Best Hedge Funds

Contents

Hedge funds are popular because of their management talent, who claim to be able to beat the market.

The sad reality is that most of them simply aren’t able to do what they claim. Why do they fail? The reasons for this are primarily psychological, ranging from confirmation bias to overconfidence. If you choose a hedge fund like hedge fund managers choose investments – that is to say, via intuition – you will likely be putting your money in the wrong hands.

So who are the really good hedge funds? The hedge funds listed below, in order of #10 to #1 are all hedge funds that have significant year-to-date returns:

#10: AIS Gold Fund

Like gold? Then you’ll love AIS Gold Fund. This is a hedge fund in the – you guessed it – gold market. Unlikely buying gold and holding it outright, investing in the AIS Gold Fund allows you to leverage their knowledge of the industry.

Not only does AIS Gold Fund buy and sell gold, they also buy and sell futures on gold. In addition, they are invested in companies that fid, mine, and produce gold.

Their primary methods of determining investments are technical analysis and quantitative analysis. Using statistical models based on past gold prices, the AIS Gold Fund has managed to consistently beat the market. They use these same models to determine how to invest in companies in the gold industry.

I’m a supporter of the AIS Gold Fund simply because, like myself, they are anti-fundamental analysis, relying almost entirely on technical analysis to make investment decisions.

Advantages of AIS Gold Fund

- High leverage

- No lock up

- Low management fee (1%)

Disadvantages of AIS Gold Fund

- High downside risk

- High market risk

Statistics on AIS Gold Fund

- Minimum investment: $250 K

- Year-to-date return: 19.18%

- Total Return: 90.30%

- Years in business: 11

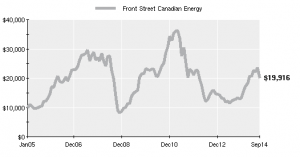

#9: Front Street Canadian Energy Resource Fund

What does Canada have that the US doesn’t? Well, for one thing, it’s colder in Canada. And cold people need energy more than warm people. Canadians are good at exploiting their natural resources and turning them into energy – and more importantly – money. Hence the Front Street Canadian Energy Resource Fund, a fund specializing in the Canadian energy market.

Front Street mainly invests in the stock of Canadian companies in the energy sector. Though it sounds rather undiversified, the fund is quite diverse within its industry, investing in companies from mining to precious metals. In addition, they invest in companies that provide equipment to the industry: engineering companies, equipment manufacturers, etc. About 10% of Front Street’s assets are invested directly into precious metals, including gold.

Front Street also funds young companies in the Canadian energy industry, hoping to leverage fast growth. Obviously, they’ve succeeded in this area.

Advantages of Front Street Energy Resource Fund

- Strong in a bull market

- Low minimum investment ($25 K)

- Both focused and diversified

Disadvantages of Front Street Energy Resource Fund

- Standard 1-and-20 fees

- High downside risk

- Highly illiquid (180 day lockup)

Statistics on Front Street Energy Resource Fund

- Minimum investment: $25 K

- Year-to-date return: 48.48%

- Total Return: 95.82%

- Years in business: 9

#8: Dreiss Research Corporation

With a name like “Dreiss Research,” you wouldn’t expect this to be a hedge fund. But it is. And they aren’t investing in science companies either. Dreiss Research does, however, use a highly scientific method of investing.

Through its Fractal Wave System (FWS), Dreiss Research applies machine learning to technical analysis, creating a diversified portfolio without human error, overconfidence, or intuition (which most people don’t have anyway).

Using week-long price charts, FWS predicts long-term patterns in stock prices. The fractal geometry system employed by Dreiss Research helps them identify turning points in stock. The technical analysis performed before a trading decision incorporates trends and price targets.

Sounds complicated? Well it works. Check out Dreiss Research’s stats:

Advantages of Dreiss Research

- High leverage

- No lock up

- Zero management fees

- Uncorrelated with the markets

Disadvantages of Dreiss Research

- High minimum investment ($1 M)

- Hard to understand what you’re investing in

Statistics on Dreiss Research

- Minimum investment: $1 M

- Year-to-date return: 64.25%

- Total Return: 3,388.21%

- Years in business: 23

#7: Reuven Capital Investments

Reuven Capital Investments is a Warren-Buffet-like hedge fund in that they primarily employ a buy-and-hold strategy of investment. However, they aren’t stupid: They also short stock and trade options when the market’s slow or bullish.

The overall trading philosophy of Reuven is that taking the long position on small and medium-sized equities is the most profitable trading philosophy. This philosophy gives birth to a strategy that isn’t heavily diversified or even “hedged,” but their results imply this strategy to work for them.

Of course, as a professionally managed hedge fund, Reuven often switches things up when the market conditions command it.

Advantages of Reuven Capital Investments

- High leverage

- No lock up

- Strong in a bull market

Disadvantages of Reuven Captial Investments

- Standard 1-and-20 fees

- High downside risk

- Weak in a bear market

Statistics on Reuven Capital Investments

- Minimum investment: $500 K

- Year-to-date return: 75.10%

- Total Return: 58.92%

- Years in business: 5

#6: Griffon Fund

The Griffon Fund believes that the phrase “two heads are better than one” can both be multiplied (e.g., 20 heads are better than one) and applied to investing. Griffon Fund employs around one dozen commodity trading advisors (CTA), using them to determine what futures to buy and sell. In short, they are a futures-focused hedge fund with a large collection of talent.

The advantage Griffon Fund gets from using more than one CTA is that it will naturally invest in diversified futures, not being affected by the bias of any one CTA. Because they constantly switch between CTAs based on performance, they can keep up with changes in the market. In a sense, they are double-diversified, switching between both investments and hedge fund managers simultaneously.

Though hiring so many CTAs is a large investment for Griffon Fund, it has paid off. In their first year, they have acquired nearly $3 M dollars to invest. They’ve nearly doubled that initial investment.

Advantages of Griffon Fund

- Access to up to 20 profession CTAs without heightened management fees

- No lock up

Disadvantages of Griffon Fund

- Standard incentive fees (20%)

- Highly correlated with the market (i.e., not hedged)

Statistics on Griffon Fund

- Minimum investment: $100 K

- Year-to-date return: 89.12%

- Total Return: 89.12%

- Years in business: <1

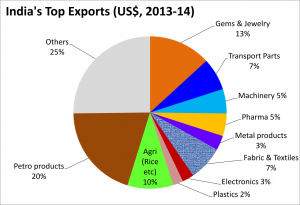

#5: India Insight Value Fund

If you want to invest in India before it follows China in terms of growth, you really need to know what you’re doing. Many of the investors around me agree that India is a strange market. I have no idea about this, but the people at India Insight Value Fund certainly do.

As an emerging markets fund, India Insight Value Fund is entirely focused on finding quality Indian companies and buying their stock. They are aware of the risks of investing in India, and therefore focus on safety as much as opportunity. At the same time, they do engage in the standard diversity of investing that most other hedge funds employ: shorting stock, buying futures, playing options, and so on. This allows them a stable return despite the local market conditions.

The investment procedure at India Insight Value Fund is primarily to find undervalued companies in India and buy their stock. Likewise, they will short stock of overvalued companies.

While performing rather poorly the past two years, India Insight Value Fund has suddenly jumped to become one of the most successful hedge funds in 2014.

Advantages of India Insight Value Fund

- Low correlation with the US market

- Risk-averse

- No lock up

Disadvantages of India Insight Value Fund

- Standard management and incentive fees (2% and 20%)

- Does not disclose assets under management (won’t tell us how many investors it has)

Statistics on India Insight Value Fund

- Minimum investment: $200 K

- Year-to-date return: 96.71%

- Total Return: 52.62%

- Years in business: 2

#4: Odysseus Fund

Ever hear of an investor with a long bias who can produce positive returns in bear markets? Meet Odysseus Fund.

Odysseus Fund invests internationally with a long bias, allowing it to find companies with which to profit from no matter the current economic state in your country. For the sake of “hedging” (after all, they are a hedge fund), Odysseus Fund also shorts stock, though their long bias is still prominent.

Currently, Odysseus has been shifting many of its investments toward the Canadian energy industry, which is much like the strategy of the aforementioned Front Street Canadian Energy Resource Fund. Could it be that Canadian energy is the key to consistently profiting via long positions?

Advantages of Odysseus Fund

- Low management fees (1%)

- No lock up

- Strong in bull and bear markets

Disadvantages of Odysseus Fund

- High downside risk

- Not exactly diversified

Statistics on Odysseus Fund

- Minimum investment: $250 K

- Year-to-date return: 100.11%

- Total Return: 284.30%

- Years in business: 4

#3: Larx Fund

Larx Fund is an options-focused hedge fund. As an options trader myself, I love the fact that Larx Fund was one of the most successful hedge funds of 2014.

The fact that Larx uses options as its main source of income should imply that they are a true hedge fund – uncorrelated with the markets. In fact, Larx’s gains are somewhat correlated with the Dow Jones, which leads me to believe that they might be long-biased despite their options-heavy trading strategy.

Larx’s trading philosophy is that you cannot predict the market over a long period of time but that short-term price fluctuations can be leveraged. I personally agree with this trading philosophy and am glad to see it working successfully for Larx.

Advantages of Larx Fund

- Zero management fees

- Uncorrelated with most markets

- Strong in both bull and bear markets

Disadvantages of Larx Fund

- High incentive fees (25% to 50%, depending on performance)

- 90 day lock up

Statistics on Larx Fund

- Minimum investment: $250 K

- Year-to-date return: 102.24%

- Total Return: 229.79%

- Years in business: 1

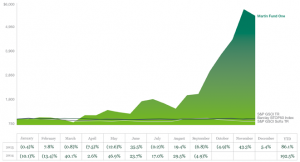

#2: Martin Fund One

Martin Fund One is a true hedge fund. Ensuring that the fund is uncorrelated with the macro markets, this fund employs a commodities trading advisor who focuses on trading so-called soft commodities, which refers to grown commodities (as opposed to gold and silver, which are mined). Martin Fund One typically trades commodities such as sugar, coffee, cotton, and cocoa.

During their first two years at work, Martin Fund One has generated yearly returns at and above 100%.

Advantages of Martin Fund One

- No lock up

- Uncorrelated with most markets

- Strong in both bull and bear markets

Disadvantages of Martin Fund One

- Standard management and incentive fees (2% and 20%)

- 90 day lock up

Statistics on Martin Fund One

- Minimum investment: $250 K

- Year-to-date return: 192.67%

- Total Return: 443.65%

- Years in business: 1

#1: TKC Investment Services

Again topping the list is a soft commodities futures trader. However, unlike Martin Fund One, TKC Investment Services relies on a fundamental, not technical, trading system. Thus, trades are based on news, government reports, and market conditions.

However, not everything done here is fundamentally based. Besides using technical indicators to determine whether a purchase is made at a good price, TKC Investment Services also carefully limits its risk with well-placed stop losses.

Futures traded by TKC Investment Services include livestock, grains, and beans. Because of their tendency to day trade, the people at TKC Investment Services are often paying out high amounts of commission, stressing the importance of daily performance. Likewise, much of the fund – sometimes as much as half – is spent on ensuring margin. Thus, you can say that much of the assets under management are not directly invested but held to avoid margin calls and to pay commissions.

Yet the numbers speak for themselves: TKC Investment Services is this 2014’s best hedge fund.

Advantages of TKC Investment Services

- Low minimum investment ($50 K)

- Uncorrelated with most markets

- Highest returns of 2014

Disadvantages of TKC Investment Services

- Standard management and incentive fees (2% and 20%)

- Much of the assets are held, rather than directly invested

Statistics on TKC Investment Services

- Minimum investment: $50 K

- Year-to-date return: 1,493.81%

- Total Return: 5,037.36%

- Years in business: 4

No Comment