Most Successful Hedge Fund Marketing Is Counter-Intuitive

Contents

- 1 Most Successful Hedge Fund Marketing Is Counter-Intuitive

- 1.1 “Prospects Won’t Read All that Educational Marketing Material”

- 1.2 “Small Investors Are Easier to Get than Big Investors”

- 1.3 “We Must Contact Investors as Soon as Possible, Before It’s Too Late”

- 1.4 “We Need to Be Able to Get Small Investors Before We Can Get the Big Ones”

- 1.5 “This All Sounds too Expensive for Our Startup Fund”

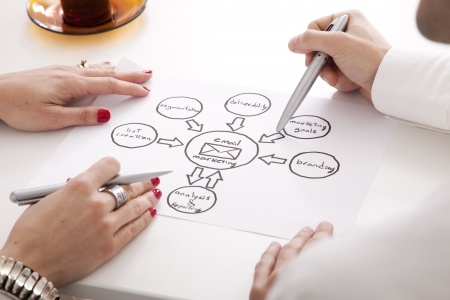

If you were to draw out a diagram of what a successful hedge fund marketing campaign looks like, you’d realize you need more paper. Truly successful advertising campaigns are multi-faceted, have long pipelines and funnels that put prospects into their correct places, and have a backend prospect-qualification system. Some of this might seem overly complex. But in the end, it not gets you more clients but also saves your hedge fund time and money.

Unfortunately, most hedge funds don’t want to involve themselves in such a complex marketing campaign. Running a hedge fund and managing a portfolio is hard enough. When you tack on a complex marketing campaign, you give yourself more work than you likely expected when you first started your fund. Hence, the average hedge fund is content with simply running a couple magazine ads and waiting for phone calls (which rarely come).

Lead-generation for hedge funds is complex, which is why the solution will be complex. Just think about what you’re dealing with when you market a hedge fund:

- Competition, with competitors that probably have a lot more money than you.

- Regulations that restrict how you can market, thereby removing many of the tools in the standard marketing toolbox.

- Prospects who have no idea what separates a good hedge fund from a bad one.

- A world in which attention is the most precious resource.

These, and other aspects, scare the average hedge fund away from dealing with the monster of marketing. Instead, they try to force a simple solution to a complex problem. They switch out a black-and-white ad to a color ad. They buy a full-page ad instead of a half-page ad. They spend thousands of dollars on a fancy website. They begin imitating competitors’ hedge funds advertising – it’s like C-grade students copying other C-grade students.

The fact is that a complex problem necessarily requires a complex solution. Luckily, if you accept this fact, you’ll be one of the only hedge funds using complex marketing, which will allow you to outright destroy your competition.

What Your Hedge Fund Marketing System Will Do

- Position your hedge fund as a market leader.

- Increase the amount invested per investor.

- Differentiate in the hedge fund market.

- Deflect prospects who would have never invested in your hedge fund.

Alas, most hedge funds, especially startups, want the above yet aren’t willing to invest in a complex marketing system to get it. They object for the following rationalizations:

- Prospects don’t need to be educated before we pitch to them.

- Low-income investors are easier to get and should be the primary target prospect.

- Prospects need to be personally contacted as soon as possible, or we’ll lose them to other hedge funds.

- We need low-income investors before we can target high-income investors and institutions.

- It’s too expensive to run a complex, multi-step marketing system.

And here are my objections to the objections:

“Prospects Won’t Read All that Educational Marketing Material”

Those prospects who aren’t willing to read or listen to well-designed education materials from your hedge fund also won’t read or listen to your pitch. In other words, your marketing materials are tools in separating good prospects from the bad. Now, not all good prospects will read your educational materials either, but you’ll find this type of prospects still coming to you, asking you about your hedge fund. Why? Because you’ve taken the effort to do something no other hedge fund has. Some prospects will therefore think, “This hedge fund seems quite professional to put all this quality material together and send it to me, in particular.”

On another note, not all prospects who won’t read your materials are prospects not interested in what you have to say. Some prospects simply want to learn about your hedge fund in another way. This is why it behooves you to send your educational materials in as many forms as possible. Consider the 7 or 8 areas of intelligence, as proposed by Harvard Professor Howard Gardner, and create materials that appeal to these areas, within reason – there’s no need to create an interpretive dance DVD for your hedge fund to appeal to prospects who learn better through music and movement.

If you get lucky with some “shopping-around” prospects, and end up being the first hedge fund they are contacted by, you’ll stand out like no other hedge fund when you use educational material as your first contact. You’ve set the expectations for what this prospect can expect from other hedge funds. And when this prospect goes to “shop around,” asking other hedge funds for their educational books, CDs, and DVDs, he’ll be disappointed. At most, he’ll get a sales package full of pamphlets talking about the hedge fund’s performance -- sales material.

Educational materials play a big part of making the prospect feel that you care about him, not just acquiring a new client. The good thing about creating a large amount of educational materials and reworking them into different forms of media is that it leaves you with a variety of possible packages to send out. Your best bet, however, is to break the marketing package up into several small packages, to be trickled out over time. This allows your hedge fund to create a “follow-up” program that other hedge funds do half-assed. Instead of a lousy “thanks for contacting us” follow-up, you’ll actually be providing them with new information every time you touch base. And with the emphasis of your material being education, you show your prospects you care about their problem, mainly financial growth and security. Compare this to the materials other hedge funds send out, materials talking exclusively about the fund itself.

Lastly, your educational materials give you the excuse to call your prospects. When you call as a follow-up to education, you can simply ask whether the prospect has received and read the material you sent out. You can then ask if he has any questions. With multiple mailings, this gives you multiple opportunities to call. Your prospect will not see this as a sales call – because it isn’t. Your materials are doing the selling.

“Small Investors Are Easier to Get than Big Investors”

This is a belief that comes from intuition – and only intuition. Unless, of course, you’re tracking the time you spend on getting each type of investor. Most hedge funds aren’t doing such tracking. Because the time and money you have for marketing is limited, why would you spend it on attracting investors whose capitals are also limited? Why not spend those resources on attracting a client ten times bigger, even if you have to work five times harder?

Small investors will also be more trouble than big investors in the long run. They will worry more about their investment. They will make more calls to your hedge fund, asking questions just to satisfy their anxieties. They will be less likely to make referrals to big investors. You might even benefit more by referring these small investors to another hedge fund, one that you have a referral relationship with, as it would save you resources better spent on getting those big investors.

“We Must Contact Investors as Soon as Possible, Before It’s Too Late”

Being on your hands and knees as soon as you can to service your prospect is a good way of lowering your status in his eyes. It’s a behavior that says, “You, the prospect, are the prize of this deal, so we are willing to work very hard to get you.”

It’s also a behavior based on fear and a scarcity mindset. You’re saying that if you don’t make your hedge fund’s staff available to prospects 24/7, you’re not going to get that big one-time opportunity investor. Responding to all prospects as soon as you can might be a good strategy if your goal is to get every possible investor you can, but in that case, I recommend you reread the previous section.

Let’s consider a quick analogy to get a better idea of the prospect’s mindset. If you’re planning on getting plastic surgery, which surgeon would you be more likely to see:

- The surgeon who’s booked for four weeks, requiring you to make an appointment.

OR

- The surgeon who’s not busy at all and invites you into his operation room to do the surgery immediately.

If you chose option 1, I pity your spouse.

Most to-be-investors are spending a good amount of time researching different investment vehicles. If you expect, like many hedge funds do, that your investor is ready to make a decision upon first contact, you’re missing out on those months and months of decision-making that the average prospect is going through. By marketing throughout the entire process, slowly, instead acting like a hungry wolf at the beginning, you’re much more likely to solidify your position as a profession hedge fund in the prospect’s mind.

“We Need to Be Able to Get Small Investors Before We Can Get the Big Ones”

First of all, there is no reason for this belief. No logical backing. No evidence. It’s just intuition, again. Logically, it’s akin to saying that you need to date ugly girls before you can get the supermodels. If anything, supermodels don’t want to be associated with guys who date ugly girls – just like big-time investors don’t want to be associated with small-timers.

Second, the point of rejecting this line of thinking is twice-fold: (1) to avoid troublesome investors, such as those who will worry too much about their investments and pull out early and those who have due-diligence problems; (2) to establish your hedge fund as “distinguishing” or “picky,” as a fund that doesn’t accept every investor. Be a fund that dedicates its time and resources to helping big investors. It’s your choice to take on small clients or big clients. And when you go with positioning yourself as a hedge fund with big investors, you naturally attract small investors. Yet if you decided to be a hedge fund for all, even small investors, you’re making it harder for yourself to attract bigger investors.

Another strategy you can employ with the small-time prospects you reject is staying on their radar after rejection. It sounds a bit sadistic, but by keeping constant contact with your rejected prospects, whether via a newsletter or new educational material, you give them something to aspire for. And when they do rise to your hedge fund’s standards, you’ll be their first choice.

“This All Sounds too Expensive for Our Startup Fund”

It very well could be expensive. So is running a full-page ad in financial trade magazines or running an international SEO campaign to your website. The difference is that this system actually works.

I never said this system is free. But you can’t market without a budget. This system is the answer to the question, “How should I spend my marketing budget?”

Ultimately, you have to know how much money you’re willing to spend to acquire an investor. If you don’t know, you may as well take the shotgun approach of spending your money randomly. Other, smarter, hedge funds will thank you for it.

No Comment