The following is a comprehensive audit for Blue Elephant Capital Management.

(If you want an audit for your own hedge fund, contact Damon here.)

Who Is Blue Elephant?

Contents

- 1 Who Is Blue Elephant?

- 1.1 Why Audit Blue Elephant?

- 1.2 Mistake #1: Lack of Exposure

- 1.3 Mistake #2: No Blog

- 1.4 Mistake #3: No Site Objective

- 1.4.1 Tip: Every page of your website should have a clear objective and give the prospect an opportunity to act on what you’re showing him.

- 1.4.2 Tip: If your website is just for display, at the very least give readers a reason to “act on your business card,” such as by allowing them to request free reports or brochures via the website.

- 1.5 Mistake #4: No Follow-Up System

- 1.6 Conclusion

Blue Elephant is a capital management group based in New York but registered in Delaware. They recently broke the $50 million AUM mark and doubled their annual returns (from 4% to 8%). Their focus is on obtaining fixed income for their clients by investing in illiquid assets. Their main investment category is short-term prime unsecured consumer loans via online lending platforms.

Rather new to the hedge fund industry, Blue Elephant has only been in business since July of 2013. Yet they’ve quickly obtained a respectable AUM. Their performance in terms of total return is somewhere around 13%, with an average monthly return of under 1%. Their performance is uncorrelated with all the major markets but highly correlated with JP Morgan.

They aim to use 2x leverage and not exceed 3x leverage. Though their minimum investment is somewhat high for a new hedge fund ($250 K), they offer a reduced management fee of 1% instead of the standard 2%. There is no lock-up required.

Why Audit Blue Elephant?

Like a sprinter, Blue Elephant has taken off fast. But they are unbalanced in their marketing, especially online marketing. Like many hedge funds, Blue Elephant seems to consider their website to be more of a business card than an investor generator, which will hurt Blue Elephant in the long-run.

Disclaimer

I am not affiliated with nor a client of Blue Elephant. I was not commissioned to write this audit. All the data in this article regarding Blue Elephant was obtained from publicly available sources – I was not supplied with any internal data from Blue Elephant Investments itself.

I am writing for both Blue Elephant and other hedge funds who wish to find better ways to market their products.

If you have any questions regarding this disclaimer, please contact me.

Okay…

So there’s lots to talk about here, but let’s start with probably the most important and helpful point (assuming Blue Elephant’s people are reading):

Mistake #1: Lack of Exposure

If you want to attract clients, you have to know how they’re looking for hedge funds. Most prospects are likely performing research online, whether it’s to understand how to invest in hedge funds or if it’s to look up a particular hedge fund, such as Blue Elephant. In that case, you should ensure your website appears in the search engines for one of two areas:

- Educational articles to attract prospects who don’t know about you.

- Your homepage appears for qualified leads (people searching for your hedge fund’s name in the search engine).

Tip: Writing educational investment articles not only gets you more prospects but also solidifies your position as an expert investment company.

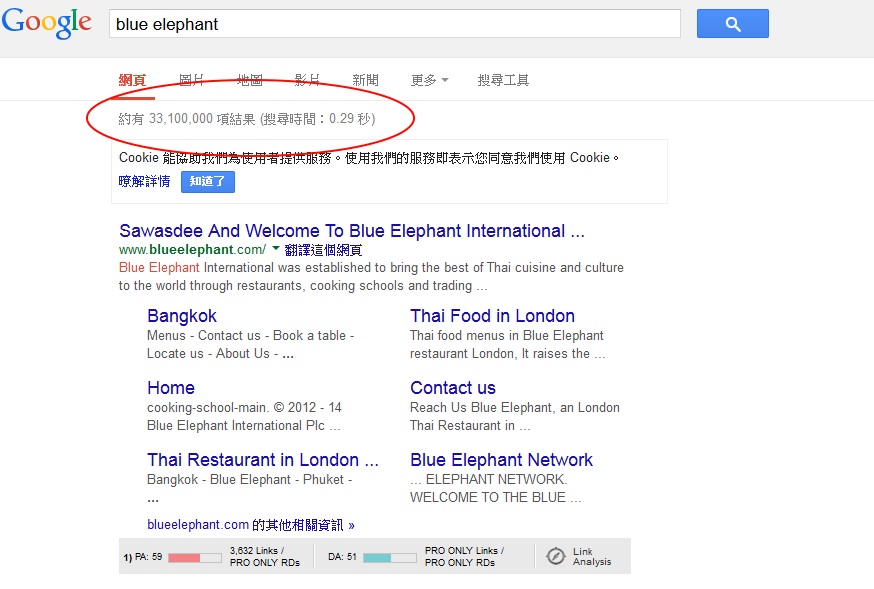

Blue Elephant does not succeed in either of these two areas, even though the second area is incredibly easy to find success in. In this second area, for instance, when I search for “blue elephant,” Blue Elephant’s web site should appear at or near the top of the search results. However:

Blue Elephant Capital Management must competing with a 33 million other websites to gain its position at the top. But didn’t I say this was easy? It is for several reasons:

- Blue Elephant’s main competitors for their keyword are cooking schools, restaurants, and IT companies, none of which have budgets larger than Blue Elephant Capital Management.

- Getting to the top of the Google rankings for your company name is typically easy because Google likes “branded” companies.

- Blue Elephant only needs to use Google Local to jump ahead of all these other listings – it’s literally a 5 minute process!

Imagine how sad it would be to lose a $250 K client simply because your client couldn’t find your website even after explicitly searching for it in Google!

You can easily fix this problem with some basic SEO techniques.

Tip: Google Local can push your hedge fund above all other competitors, and all without having to shell out money for SEO!

Mistake #2: No Blog

Blogs can help hedge funds get lots and lots of traffic, within which are lots and lots of investors. A blog should both educate people and generate leads. In the hedge fund industry, blogs are especially effective because investment information is timely and fueled by changing mindsets and news.

Too many hedge funds are timid or have horde-like mindsets with the information and trading strategies they possess. This is sad. It’s as if hedge funds are worried that if they teach investors how to use their investment techniques, the investors will simply invest their own money instead of setting up a meeting with the hedge fund.

This way of thinking is incorrect. An investor wants to first know how you do it. Then he wants you to do it for him.

It’s just like when you want to install a new TV on your wall. You’ll probably look up the process of mounting a TV on your wall just to understand how it works. You don’t plan on installing the TV yourself.

But once a TV installation company has given you the free information of how to mount a TV over your fireplace, you’re more likely to trust that company with your TV. Thus, you’re more likely to call them over to perform the installation for you. For the TV company, giving prospects this free information helps business.

And so it is so for hedge funds. With an educational investment blog, you can cement your investment expertise in the mind of the prospect. This makes the prospect more likely to trust in you as opposed to other hedge funds.

Tip: A blog is one of the cheapest ways to attract investors to your website.

Because Blue Elephant would be starting from ground zero, I would recommend the following 5-step content plan for their blog:

- Scan the news for topics of interest in the hedge fund or investment industry. You can use Google Alerts to save you time (basically, what Google Alerts does is send you news articles that match your specified topic of interest every morning). Choose a topic you can write on.

- Take a different stance on that news article. Instead of simply parroting what the article said in your own words, take a different stance, using your own investment strategies and principles to explain how your hedge fund interprets the news.

- Write the article. A good blog article should be at least 500 words long.

- Write a viral headline to attract more people to the article. Use my “Marketing Tips” section for information on how to write good headlines.

- Spread the article about via social media and industry connections.

Tip: Your website is useless if no one can find it. Blogs make your website findable.

Mistake #3: No Site Objective

As it stands, the Blue Elephant Capital Management website has no clear objective. Its only direct-response mechanism at this time is a dry contact form – “dry” meaning without a call to action. At the moment, you can only request “addition information”:

Tip: Every page of your website should have a clear objective and give the prospect an opportunity to act on what you’re showing him.

If Blue Elephant knew its objective, they could utilize their website in a much more effective way. After all, their current website is a single, segmented page, which should imply a single goal. Many ecommerce websites use single, segmented pages to very high conversion rates (I’ve worked with ecommerce sites of this type that had 4% conversion rates – imagine if 4% of your traffic were asking to set up meetings with you!).

But at the moment, Blue Elephant’s website appears to only serve the purpose of an online business card. As you probably know, business cards do little in getting business. What’s important is the relationship built through handing off the business card, which is why a blog plus a call to action is so important for most online businesses.

Tip: If your website is just for display, at the very least give readers a reason to “act on your business card,” such as by allowing them to request free reports or brochures via the website.

Mistake #4: No Follow-Up System

Every hedge fund should have a follow-up system. Today’s website tools allow for various means of information capturing. Blue Elephant should add such a tool, allowing it to remarket to leads that arrived at their website.

Some methods of remarketing include:

- Information capturing via snares (more on this in my “marketing tips” blog) – essentially, you trade information for a prospect’s email address, physical address, or phone number.

- Popups offering email subscriptions.

- Cookie-based advertising in which your ads appear on the user’s Internet browser when they leave your site.

At present, Blue Elephant is doing none of these. Though the first two options require a bit of time and effort, Blue Elephant could easily run some remarketing ads, which only require some money (and are cheap!). Letting prospects leave your site without capturing their information is like ignoring a whole in your boat – plug that whole up!

Tip: Letting prospects leave your site equates to wasting the effort spent getting prospects to your site. Do what you can to capture their information.

Here are three steps Blue Elephant can use to establish a follow-up system:

- Allow a trust-based exchange. Offer something of value in return for visitors’ information. For example, offer a free brochure or report sent via mail. To send the report, you of course require an investor’s address. You earn trust by offering them free information. This trust allows you to later market your hedge fund to these investors.

- Maintain constant contact with investors. Most investment decisions take months. Sometimes, an investor spends a year researching investment vehicles before choosing a hedge fund. Keep your hedge fund fresh in your prospect’s mind by maintaining weekly contact with him. Send him weekly newsletters or investment reports. You can even send out your weekly returns to him as a way of making him feel “left out” when you hit a good week (e.g., 50% returns).

- Ask for action. You don’t have to directly ask your contacts to invest in you. But you should at least ask them to do something – anything – in response to your letters. By acting, they invest energy in you. This is a psychological technique to breed loyalty. By responding to your surveys and sending you their feedback, they are becoming part of your team. This makes them more likely to invest in your hedge fund in the future.

Tip: Even hedge funds can use psychological techniques to move investors to a closer “psychological distance.”

Conclusion

I hope the above four tips can help Blue Elephant a turn their business-card website into a vehicle for attracting investors. If you feel this audit was useful, please let me know by contacting me here.

No Comment